The Real Cost of Bypassing KYC in Channel Payments

With the frenzy to scale up operations, most brands skip one of the most important steps in channel partner management—Know Your Customer (KYC) verification. Bypassing KYC might look like an extra bit of red tape, but it can cost firms much more in the long term—both financially and in terms of reputation.

Why KYC is Important in Channel Payments

KYC is not a regulatory tick-box. It's a first step to guaranteeing those receiving your payments are valid, verified, and responsible. For brands with hundreds or thousands of retail partners across the FMCG and consumer goods industry, KYC becomes even more vital in risk management, compliance assurance, and evading fraud.

The Unseen Burden of Skipping KYC

Fraud & Identity Threat

Without proper KYC, your brand is exposed to impersonation, ghost retailers, and fake accounts. Payment is likely to get directed to non-existent recipients or channeled to off-target recipients, resulting in revenue leakage and erosion of trust among genuine partners.

Regulatory Sanctions

Regulators and banks need to follow KYC to prevent money laundering and tax evasion. In case your company is found to be evading the rules, it can attract hefty penalties, audits, or even operation caps.

Delayed Disbursals

When the KYC is not conducted during the onboarding stage, payment problems ensue. Incomplete documents, unverifiable customers, or inconsistent data delay payments, destabilize your supply chain, and enrage your trade partners.

Loss of Trust

Your partners want prompt, transparent payments. Constant errors or delays due to KYC mismatches negatively impact your brand reputation. Competitors with faster processes can easily steal partners, affecting your market footprint directly.

Operational Inefficiencies

Manual payout processing and compliance without an effective KYC system typically creates inefficiencies, including more follow-ups, paperwork mistakes, and redundant work—wasting precious time and resources.

The Smarter Way Forward

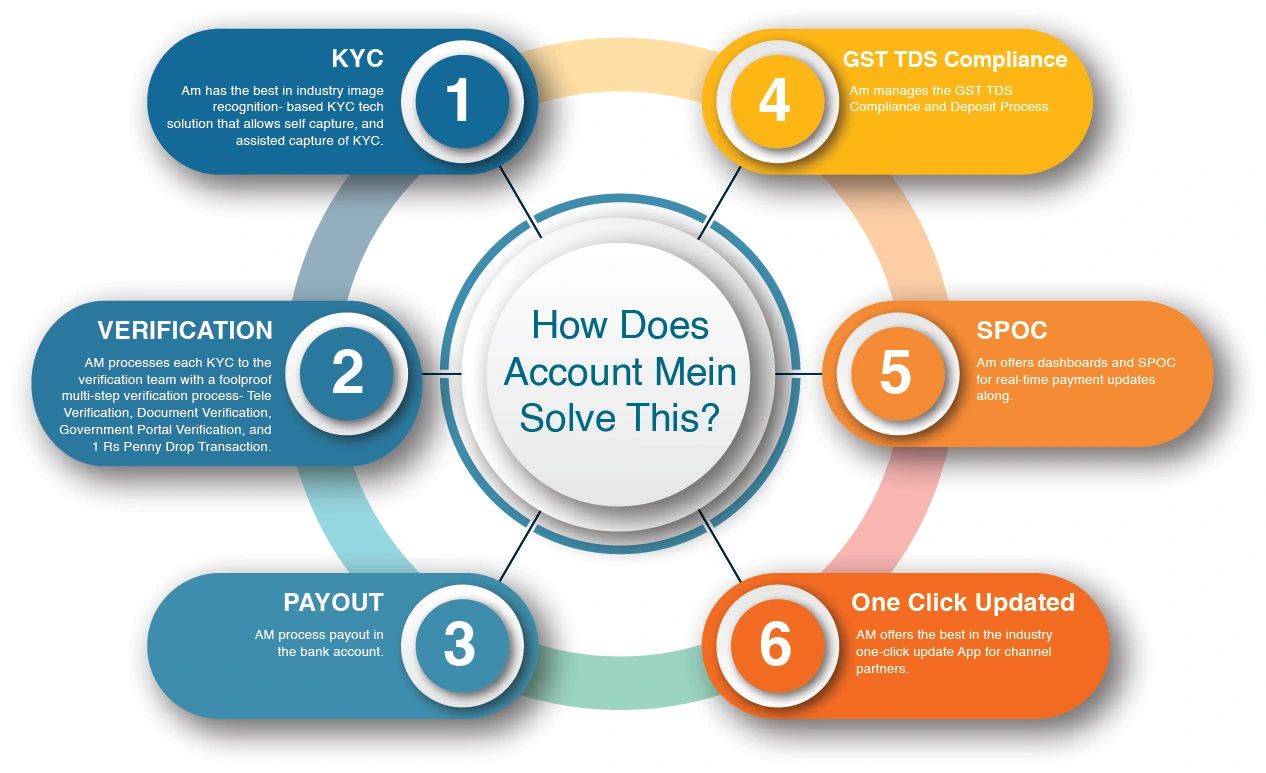

Rather than viewing KYC as paperwork headache or hassle, brands must integrate it into a seamless onboarding and payout experience. AccountMeIn-like platforms facilitate it with scale KYC gathering and verification.

With AccountMeIn, brands are able to:

- Collect PAN, GST, and bank account verification information from retailers with ease

- Maintain legal and tax compliance

- Avoid payout inefficiencies with a verified, centralized database

- Identify mismatches and exceptions the moment they occur to prevent issues

Final Thoughts

Avoiding KYC isn't just dangerous—it's expensive and damages reputation.

Investment in a centralised system like AccountMeIn not only protects your enterprise but also leads to more enduring, stable partnerships in your network of retailers.

Don't let poor compliance hinder your growth. Partner with AccountMein as your starting point towards intelligent channel payments.

Comments

Post a Comment